SaaSifying Public Sector Healthcare IT

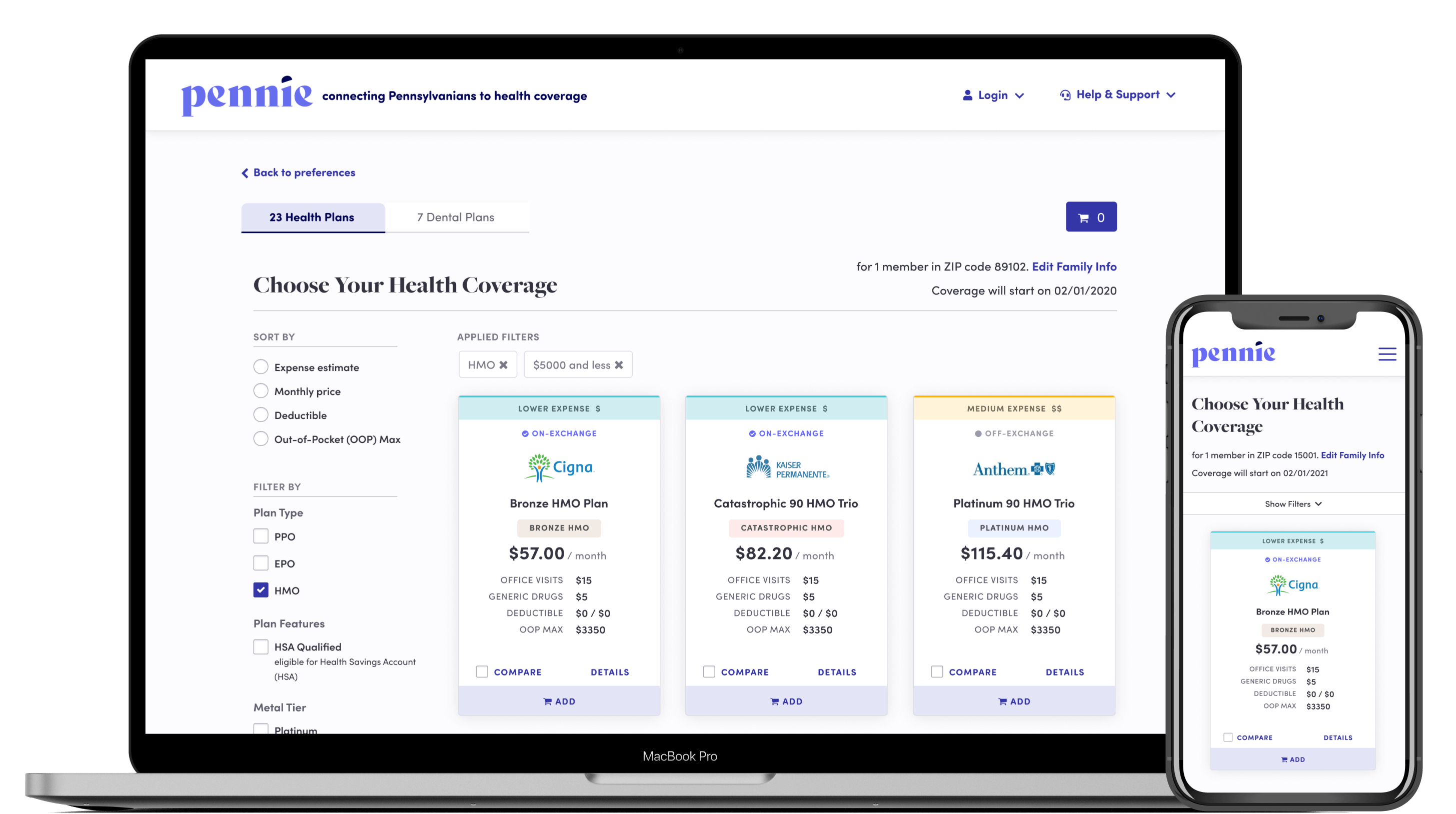

GetInsured’s mission is to enable access to affordable health insurance for every American by bringing modern technology to public and private healthcare delivery programs. We’re a market-leading end-to-end service provider of SaaS technology for public sector healthcare, seamlessly integrated consumer assistance center operations, and implementation and project management services.

3 million Americans enrolled across 7 states

GetInsured’s technology platform is mature and spans implementations in eight state-based marketplaces across the country, including State-Based Marketplaces in Idaho, Washington, Minnesota, Nevada, New Jersey, Pennsylvania—and launching this year—Georgia, and Virginia, making them the leader in State-Based Marketplace technology.

What our partners are saying

Recent News

Get in touch

Want to learn more about what GetInsured can do for you? Drop us a note and we’ll get back to you shortly.